A lot of times, the market bottoms and or goes up when no one believes it can. That is a contrarian view, but a lot of times, when things look the worst, that is when you have to look for a potential turn. Of course, they can get worse, but you have to be open minded.

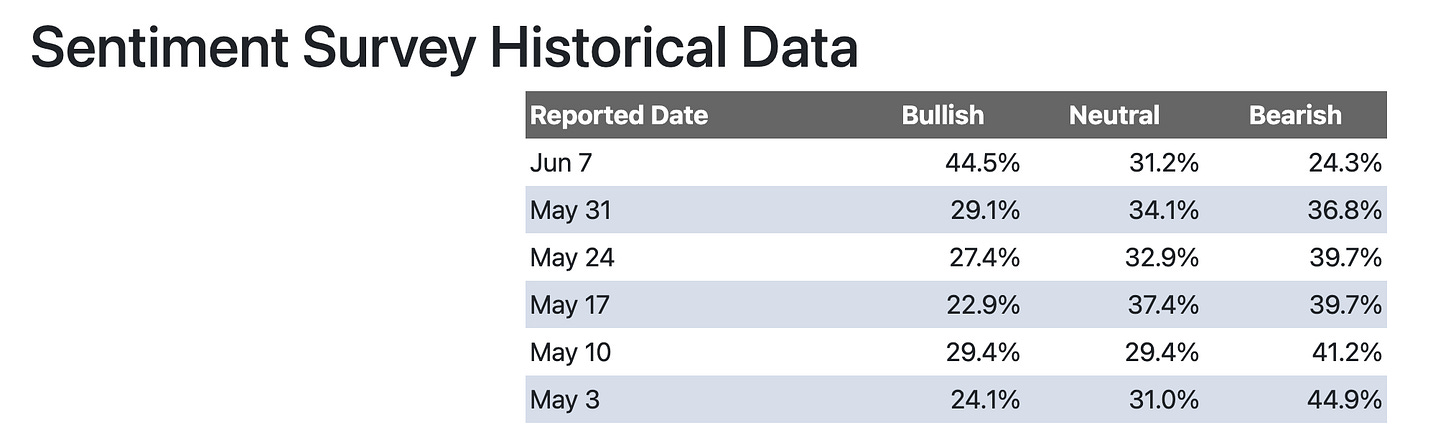

On the other hand, you have to be mindful of the other side as well. If you look at the latest sentiment survey from the AAII you can see how many people turned bullish this past week. This is the highest bullish percentage reading in the past year.

This does not mean that the market is going to go down by any means, however it does certainly tell us it could and that we need to be defensive and protect any gains in capital over the last month.

Many have been worried about breath and the lack of expansion during the latest rally. The indexes have been pushed higher by gains in the large caps and there has been weak participation. However, what if more stocks join the party and those numbers increase? We have had 6 straight days of net highs. Hopefully this continues to broaden out.

Also, when you look at the commitment of traders over the past 6 months, large traders were getting more and more short. They did not believe the market was capable of moving higher. For the first time in a while, there was short covering this past week. I am looking at the green line at the bottom. You can see that when data came out, there was a nice turn up.

SPY gained a very small amount this week. If you look at the daily chart, Friday had a doji candle which could signal a reversal. This could signal a reversal or pullback. I personally would like to see SPY pullback to its 10 week moving average which is at $417 right now.

SPX looks very similar and looks like it wants to stay above the 4200 level.

The Nasdaq also had a very small gain. The 10 day moving average is catching up quick.

The QQQ has not had much of a pullback since March. This would be healthy if the QQQs could pause of even come back and test some levels to see where support is. QQQs also put in a doji candle on Friday.

The Russell ETF IWM came up to the downward trend line, tested and closed below. There is nothing wrong with this. Another week or two here as consolidation before breaking out would be great for the overall market.

The VIX is so low it is almost concerning. It is a great sign though.

Stocks above their 50 day moving average keeps putting in higher lows for now.

The equal weight S&P ETF RSP could breakout soon.

For the third week in a row, TLT closed below the trend line. I would like to see this change this week.

DXY came back below its line of interest as it closed below $104.

Gold closed back above its trend line after closing below the previous two weeks.

Bitcoin can change directions very quickly but at the time of me writing this, it looks to be on the verge of breaking down again. Hopefully, a week below 25000 will find some buyers and have a false breakdown reversal to build for another move back up which get bitcoin above 30,000 again.

There are many many reasons why to be bullish at this point in my opinion. The market looks great. However, many people finally started to believe, which could lead to a shakeout. This does not need to take place, but we certainly have to be aware of possibilities.

Have a great week!