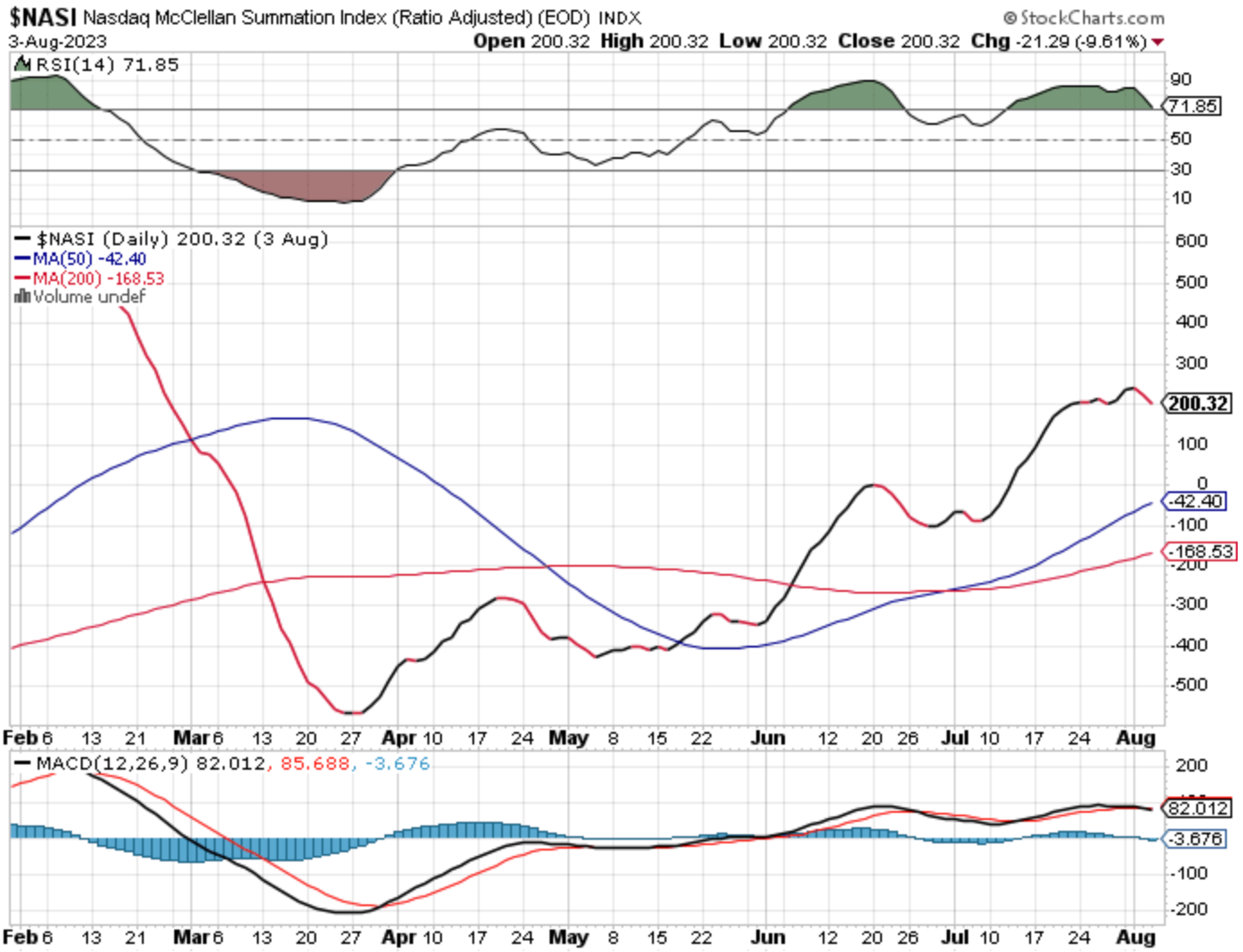

Last week we talked about how the NASI was possibly giving clues as the MACD looked ready to cross. It does now look like the market may take a couple weeks to digest gains made earlier in the year. However, I am still extremely bullish as the long term trend is up, but now is not the time to push one’s luck. Unless something drastic changes, I will not be taking any longs next week. The NASI will likely stay red, although we must be open to quick turns. I do not want to get chopped to pieces fighting the market, so my game plan for next week is to sit and watch.

SPY lost over 2% this week with a bearish engulfing candle this week. Support at the 10 week moving average lower at 442.

SPX could not get above 4600 this week which has proven to be a big level of interest in the past.

The Nasdaq lost nearly 3% as it also put in a bearish engulfing candle this week.

QQQ had a big down week losing just under 3%. It also closed right at 372. It may chop for a week or so before resuming down as it works to find support.

IWO broke out 2 weeks ago but is not backtesting the breakout line. Look for a undercut and rally over the next couple weeks. The Growth ETF lost 1.74% this week.

IWM also lost over a full percent. I could see this testing the 189 level over the next couple weeks before resuming higher.

XLF, the financial sector ETF, tested 35 and bounced lower.

SMH, the semiconductor ETF, seems as if it may end up making that handle. The semiconductors will still be a big big part of the next bull run, but they need to digest their gains before setting up again. It did not have a bearish engulfing candle, but it was very close.

Volatility is something we noted could pick up during this period, and you can see the VIX certainly woke up by jumping 28%.

TLT had a major move down this week. Last week we noted how it looked to be breaking down and could signal a move down for equities.

Gold also moved lower by closing below the downward trend line.

The dollar moved higher, but only a small amount in 0.30%. DXY may move lower next week, but then could push up towards 105 shortly after.

Bitcoin perked up for a quick moment this week only to drop back down. I still think Bitcoin has more to shakeout before firming up for a big run.

Ethereum looks very similar. I think a shakeout to 1760 would still be very healthy and then can move up for a big healthy move up.

Tickers that I will be watching closely include AI, IONQ, LI, NVDA, PLTR, SMCI, UPST. Once the market is finished pulling back, these are stocks that I would like to get positions in if they pullback in a constructive manner.