S&P lost over 2% this week which has corrected nearly 6% from the recent high. There was no pause at the 10 week moving average. The S&P just kept moving lower.

The Nasdaq also moved down for the third week in a row. The Nasdaq is now roughly 9% off its recent highs as it moved down 2.59%.

The Dow Jones was holding up the past couple weeks, however that changed this week as it also corrected more than 2%. It also closed below the 34600 level.

QQQ lost 2.21%. This could very well find support at 350 which could coincide with the trend line and close to the 30 week moving average (purple line).

IWO had a rough week losing over 3%. This closed right at its 30 week moving average.

IWM also lost over 3%. I do think this is at an interesting level. It is touching the trend line as well as the 30 week moving average. This may be an interesting spot for IWM. I am not saying it will bottom here by any stretch, but it certainly could and will be fun to watch.

SMH did have a red week but barely. This is very close to a doji candle, which could signal a reversal.

A large component of SMH is NVDA. This has certainly been a leading stock this year as it is certain to be the big beneficiary of the AI explosion.

Earnings are Wednesday after market close and everyone is going to be watching to see the reaction. Personally, I would like a sell off so we can bottom and then have a good clean uptrend. If the reaction is very strong and we gap up, it will be harder to get positioned and likely a lot of chop or whipsaw action afterwards.

Last week I noted that I did not think the VIX will stay down after the big down week last week and it gained it all back gaining over 16%.

TLT showed no sign of bottoming this week.

DXY keeps moving steadily higher. That $104 level will be a big test. A rest here is a high probability regardless of it is going to move higher or lower. It makes sense for both scenarios to just have a rest here.

There was news and rumors around the bitcoin ETF this week. Selling off on good news is never a good sign. Hopefully, it is just a last flush before moving up. Time will tell. Like I stated previously, the ETF is not a matter of if but when. It is going to happen and I think the BlackRock ETF will get approved.

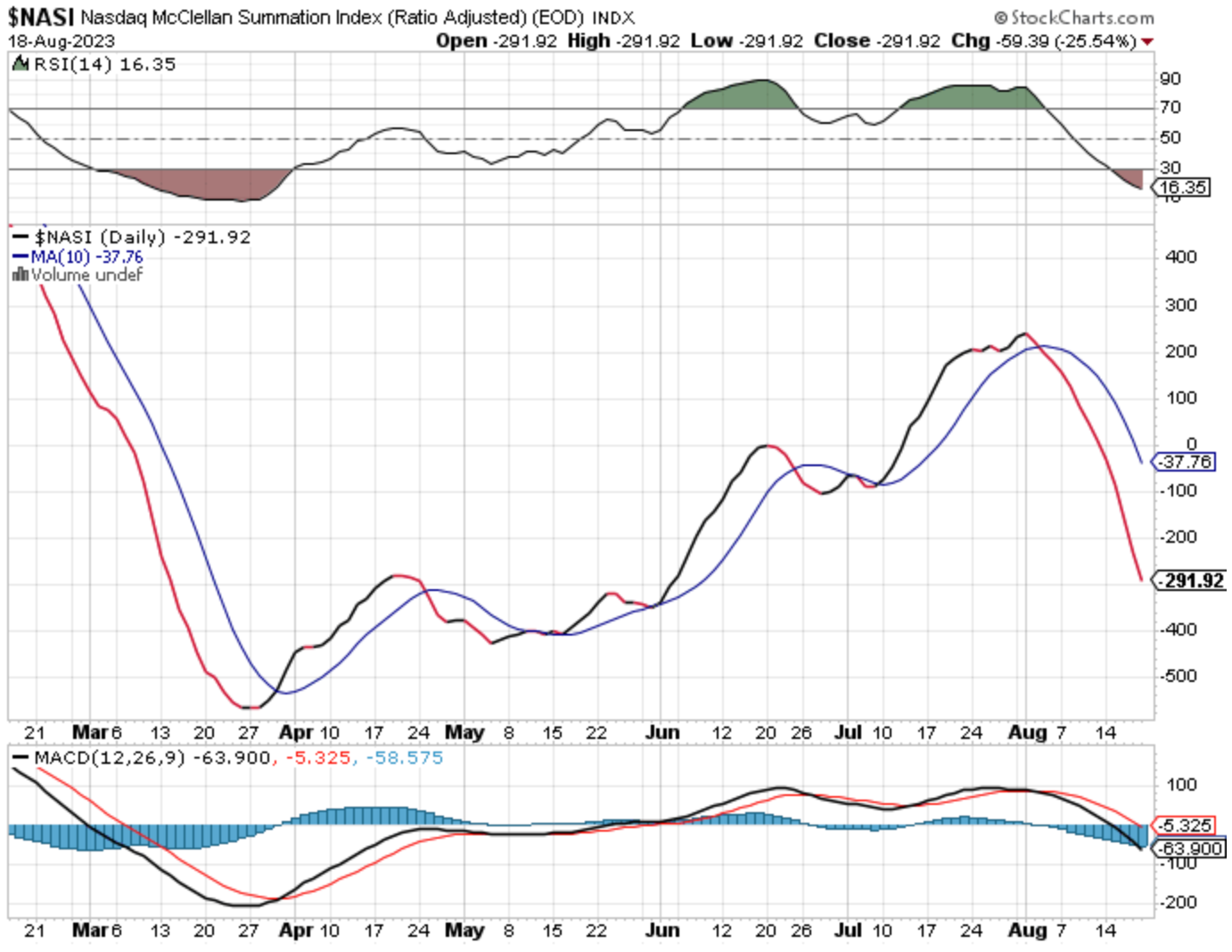

Looking at the NASI, I am not seeing signs of a turn just yet. Of course that can change quickly but just like how we waited for a MACD and RSI turn at the top in late July, we wait to see the turn here.

The best play in my opinion is to remain patient.

Have a great week!