For the second week in a row, the indexes closed down. SPY has not had 2 consecutive down weeks since the first two weeks of May. SPY however, did bounce at its 10 week moving average (blue line). This is a big level. A lot of investors typically buy a stock on a pullback to this area.

SPX lost 0.31% and also bounced at its 10 week moving average.

The Nasdaq Composite had more damage this week than the S&P. The Nasdaq closed below its 10 week moving average and lost 1.9%. Similar to last week, it also closed near the low of the week. That is a sign that selling pressure was strong.

The QQQs also had a rough week losing over 1.5%. The QQQs also lost the 372 level which could have served as an area of support. This certainly is not the end of the world by any means, however, we need to be mindful that more damage could come quickly and easily.

There has been no love for growth stocks during this pullback. IWO lost 2.26% and also sliced through its 10 week moving average.

IWM had a down week, but remains above its 10 week moving average. It may have found some short term support at the 189 level.

XLF remained mostly flat.

If you pull up the newsletter from a few weeks ago, I mentioned that SMH may do its best to scare people out before moving higher a great deal. It certainly has scared people away.

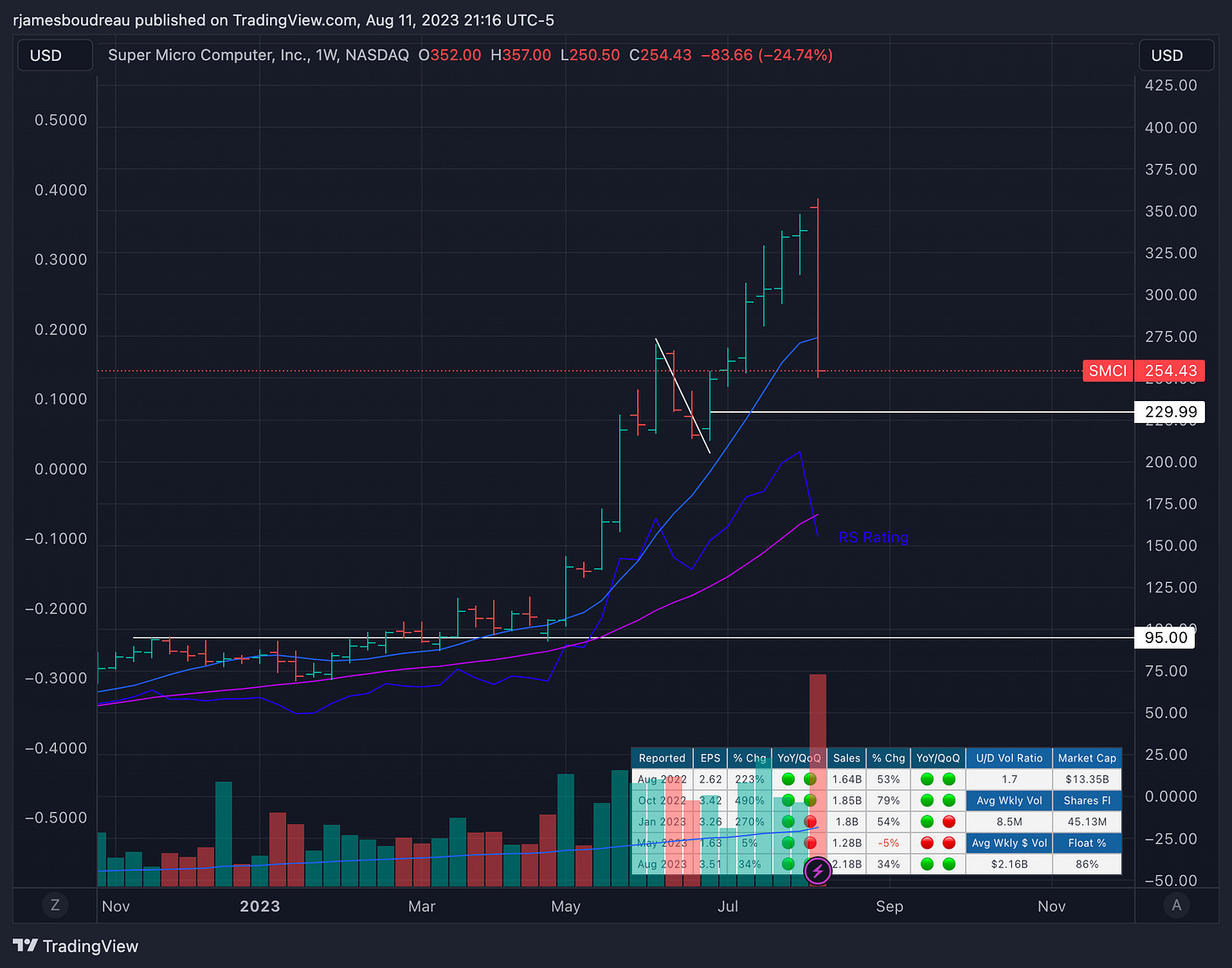

A lot of this damage was done by SMCI and NVDA as they had extremely rough weeks as you can see below.

The VIX did close lower this week as it lost over 13% but not before it spiked up to start the week. I don’t think this will continue to move lower just yet.

GLD could not find a bid all week long as it looks to be breaking down.

Bonds continue to move lower and look very weak. It looks as if TLT may soon test 92 in the coming weeks.

The dollar regained its 10 week and 30 week moving average lines as you can see below. I don’t think the dollar shoots higher from here, but I do think it is very possible for it to go over the $104 mark before moving back lower.

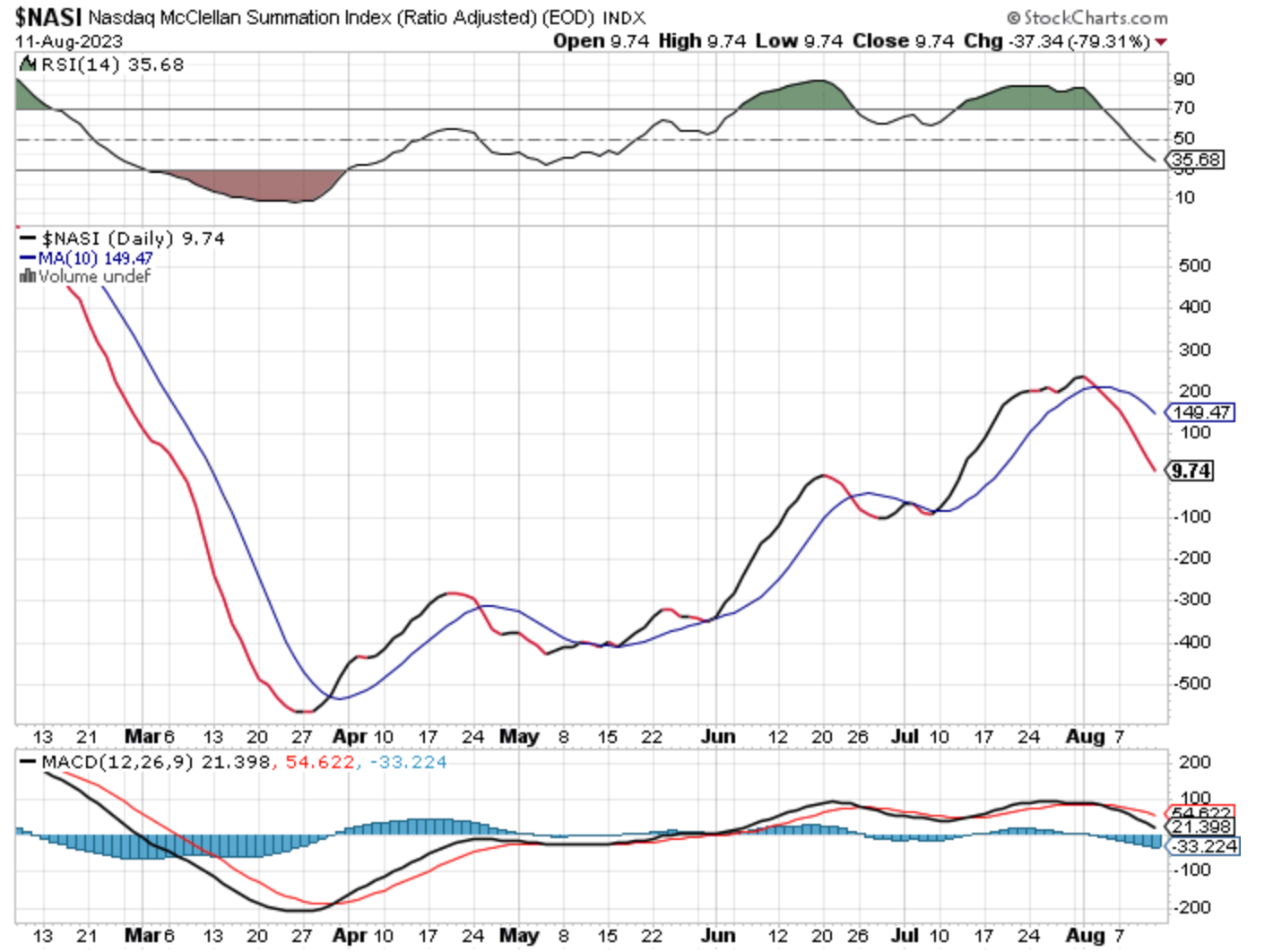

The NASI gave us warnings that the market could move lower. Now, we sit and wait to see when we may get a turn back up. We are approaching oversold levels and low points on the MACD however, we need to be patient and not go back in too soon. Oversold things can stay oversold for quite some time just like the NASI stayed overbought for nearly a month!

New lows continue to outpace New highs daily at the moment. As long as this continues as well, there is not need to jump back in.

Bitcoin sure did look like it wanted to move higher for a quick moment this week. Then, it just moved lower and has been sitting as supply continues to dry up. I have an alert to go off once price moves over $30,220. Let’s see what happens at this level.

There are some charts that have not completely broken down yet. Keep a list of these as they may be the ones that shoot higher the quickest once the market turns up.

Have a great weekend!